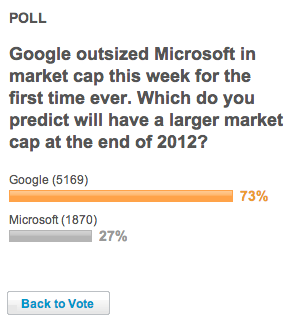

I just saw this poll on the front page of Yahoo Finance:

For background, Google’s market cap at today’s closing is roughly the same as Microsoft’s. (247.56B vs 248.65B). The Beta for MSFT is 1.00 vs 1.09 for GOOG. If you know anything about finance and math, this means roughly 50/50 odds for either company (especially over 90 days).

The poll question is equivalent to asking people to predict a coin toss. 73% of the people are calling heads, 27% are calling tails!

The information I get from this: more people would like Google to worth more than Microsoft by the end of the year. Because nothing is on the line, they answer the poll accordingly. However, when it comes to putting their mouths where their money is, the stock market gives us 50/50 odds.

If you don’t understand or don’t agree with the above, please read one of the following two books before making a comment:

A Random Walk Down Wall Street by Burton Malkiel

The Signal and the Noise by Nate Silver

Even if you do agree, check them out if you haven’t. If you needed a license to buy stocks, Malkiel’s book would be required reading.

Beta is a volatility measure and that can be up or down. You want to look at sharpe ratio.

http://www.macroaxis.com/?pitch=marketRiskAndReturn&mm-portfolioHome&sm=marketRiskAndReturn&single=true&s=GOOG,MSFT,YHOO

Checkout NP for more dialogue along this subject.

http://www.nuclearphynance.com/

Best,

Dan

I think voters are partly basing responses on which firm’s services they are personally using more and more of.

It will be more exciting to have a nickel price to vote. That would go a good distance to discourage any voting fraud. The financial market is a voting system, but what you discover is that people place a meaningful financial bet and they refuse to acknowledge when their investment thesis doesn’t play-out. It is a fantastic place to analyze human behavior, but it has its limitations. When your future, driven by monetary obligations, is on the line, it’s hard to not be strongly biased. People like to hire brokers and financial advisors to outsource the blame. It would be horrible to have no one else to blame for your poor portfolio performance! Lol

Good thing someone is working on a better system! 🙂